Understanding the importance of customer lifetime value

Customer lifetime value or CLV is a measure of how much each customer has spent with your business. It’s a hugely powerful metric that’s surprisingly under underused. So to prove how useful this can be in this post, we’ve pulled together a list of the key marketing and general business benefits you can gain from by understanding this key metric.

Working out your customer lifetime value

Customer lifetime value is the total value created by each individual customer during their activity with your business.

In accounting terms, that’s the trading history between your business and each individual customer.

Understanding this key metric within your business can simplify your marketing planning, makes measuring progress easier to understand and can help you unlock significant new opportunities to drive revenue.

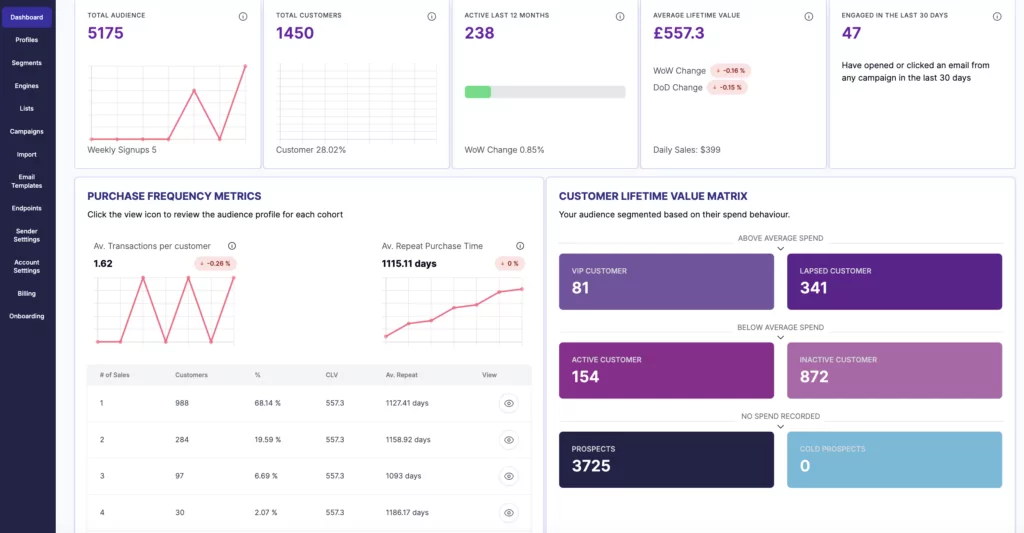

See a typical Websand dashboard below. Key customer metrics are all driven by the average customer lifetime value metric.

1 – Using customer lifetime value to measure your customer loyalty

The average of your customer lifetime value (CLV) gives you a great metric to really understand the underlying performance of your business.

It’s a great way of measuring your customer loyalty, if you’ve got growth in sales but your CLV is dropping, then people aren’t sticking around and ultimately you are going to have a problem.

So it’s a great idea to set your average CLV as one of your key business performance metrics.

For example – this year we are targeting a 10% increase in CLV.

When you focus on this as a metric, it can make a heck of a difference.

2 – Segmenting your customers by customer lifetime value

If you’ve set an objective to increase customer lifetime value, then it’s logical that you’re going to want to group your customers based on the same metric.

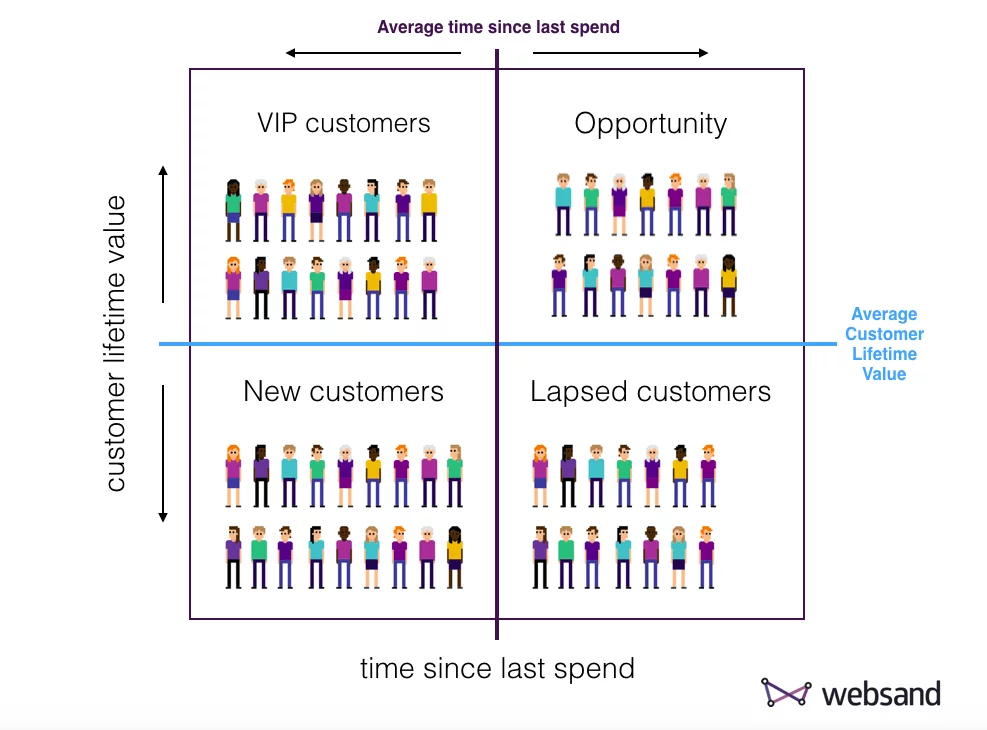

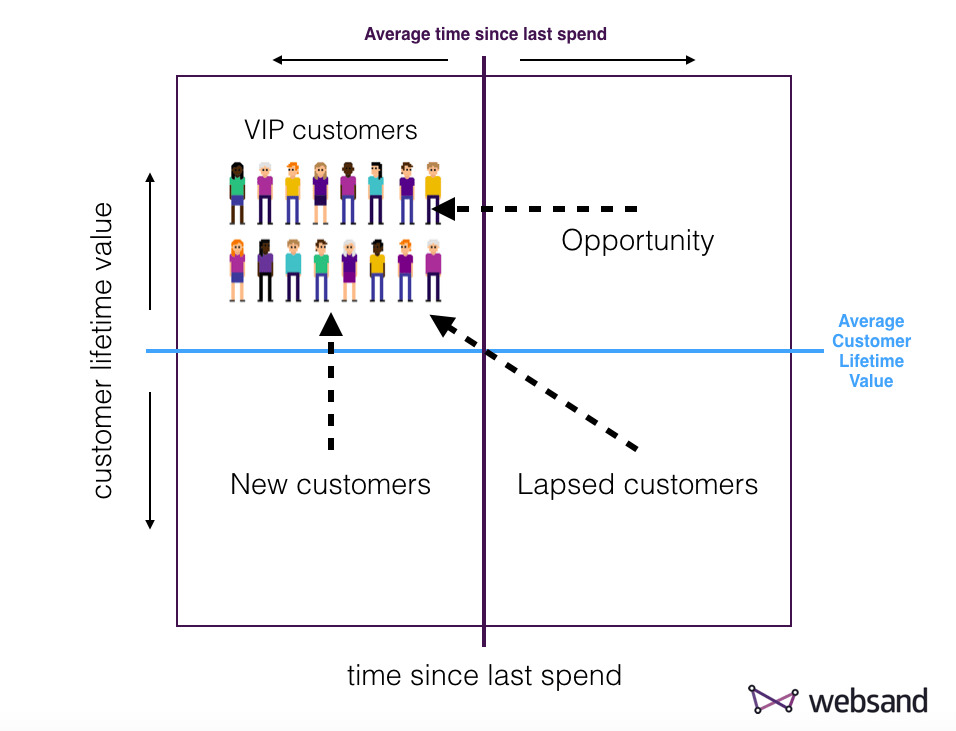

We always recommend that businesses look at customer segmentation based on customer lifetime value and activity.

The model above shows a matrix that we use a lot. Breaking your customer audience into segments based on those who are adding the most value, and whether they are currently active. It’s a tool to help you really understand the behaviour of your customers and where you need to focus to make the biggest difference.

3 – Building marketing strategies based on customer lifetime value

Once you understand customers based on their customer lifetime value (CLV), it’s easier to create relevant marketing strategies to certain customers.

For example…

If someone hasn’t spent with you for a while, but they have a CLV that is above average, then you have justification to offer a really strong promotion offer to get them to return.

If you’ve identified a customer segment that haven’t spent with you for a while but are below average CLV, then it’s pretty clear that you’ll be less likely to invest in these customers as they’ve added that much value to your business in the past.

4 – Using customer lifetime value to find the best new customers

Let’s say that you create a segment to group those customers above customer lifetime value (CLV) who have recently spent with you.

I’d consider them your VIP’s. So not only do you want to make sure that you keep their business. I’d suggest that you also want to understand more about the profile of these VIP’s. Who they really are, and importantly where they came from.

If you are able to identify a trend, and I’m sure you will. Then you’ve just found out where that’s where the potential VIP’s of the future hang out.

Focus your marketing acquisition efforts in these locations and you’ll adding new customers that will be the VIP’s of the future.

Remember to also do the reverse on those customers that have a below average customer lifetime value.

5 – Using customer lifetime value to focus on customer retention

The old saying of “half of my advertising is wasted, I just don’t know which half” is still relevant today, even though the majority of marketing is now highly measurable.

So consider this….

You have a group of solid customers that add regular value to your business. The VIP’s. Yet you may be spending the majority of your marketing budget on regular advertising.

Now you know more about your customers based on their value. Perhaps you might want to rethink your marketing spend, and allocate some of your valuable marketing budget to keeping the VIP’s happy.

Remember – when you make customers happy, they tend to tell their friends. And those ‘friends’ are more than likely to be high value customers for you too!

6 – Using customer lifetime value to understand your real customers

Using CLV customer segmentation, you now know how many customers are spending with you regularly, and how many aren’t. It’s now also easy for you to work out how much that’s worth to your business.

If you are a regular investor in market research or focus groups, then you can use these customer segments to understand why. Why are people spending a lot with you, and why are people not spending money with you.

Not only could that give you some really valuable secrets to benefit your business moving forward, it could also give you a something to review as a customer satisfaction measure in the future.

7 – Creating customer loyalty using customer lifetime value

Customer loyalty is often measured by the issue of points. Points are used to represent the value of the customer to the business.

Now you’ve started using customer lifetime value (CLV) as a measurement, you’ve got an indicator that tells you how much each customer is worth.

With your customer lifetime value (CLV) metric in place, you can use metric as a ‘trigger’ to offer new benefits, special discounts or whatever else you think might be appropriate.

If the CLV = £200 – give them free shipping.

For a CLV = £300 – give them pre-sales access.

If the CLV = £1000 – send them a gift.

The process would work the same way as a sales funnel, so we this process a loyalty funnel.

Use your imagination and put the ‘fun’ in your loyalty funnel

8 – Showing business value through customer lifetime value

Now you understand your customer lifetime value you can prove the true value and worth of your business.

That’s an impressive statistic to show future investors or even buyers of your business.

Putting your customer lifetime value measures in place.

That’s scratching the surface of how you can benefit from understanding your customer lifetime value.

It’s a great way to unlock the secrets of your customers. To drive real growth using business information you already hold.

At Websand we’ve built a platform that helps you to identify customer lifetime value. Giving you the platform to create marketing strategies that will make your customers loyal and drive your business forward.

Giving you the tools to manage your customer data and develop strategies to increase your profits, reduce customer churn, and increase customer lifetime value.

Sign up here for a free 7 day trial, or via our Shopify APP if you are a Shopify user and check out your retention stats

Get in touch and let’s create some real value.